Blog

Be Careful When Signing Up For Health Insurance!

Here’s a true story about a woman who thought she was signing up for the ACA (“Obamacare”) insurance, but got scammed by a look-alike website. She Googled the Affordable Care Act and ended up on another website without her knowledge. The URLs are designed to confuse, and you need to look VERY carefully at the…

Read MoreNew Exemptions Affect Contraceptive Services

On October 6, 2017, the U.S. Departments of Health and Human Services, Labor, and the Treasury (the Departments) released final, interim regulations allowing non-governmental employers, institutions of higher education, and individuals with religious or moral objections to cease coverage for some, or all, contraceptive services. Background All non-grandfathered health plans must cover certain preventive items and services without cost-sharing, including contraceptive…

Read MoreBuy Out Agreements or Corporate Stock Redemption Plans

Many small closely held corporations and partnerships have a written agreement as to what must take place if: A shareholder or partner leaves the firm willingly Dies an untimely death Becomes disabled These are referred to as either “Buy Out Agreements or Corporate Stock Redemption Plans.” The problem with many of these agreements are most…

Read MoreHealth Savings Account (HSA) Contribution Rules

Brought to you by Kistler Tiffany Benefits Many employers offer high deductible health plans (HDHPs) to control premium costs and pair this coverage with health savings accounts (HSAs) to help employees with their health care expenses. An HSA is a tax-favored trust or account that can be contributed to by, or on behalf of, an…

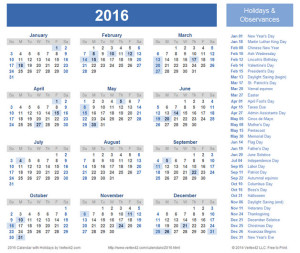

Read MoreIRS Announces 2016 HSA Limits

On May 4, 2015, the Internal Revenue Service (IRS) released Revenue Procedure 2015-30 to announce the inflation-adjusted limits for health savings accounts (HSAs) for calendar year 2016. The IRS announced the following limits for 2016: The maximum HSA contribution limit; The minimum deductible amount for high deductible health plans (HDHPs); and The…

Read MorePurchased Coverage through the Health Insurance Marketplace?

New 1095-A Tax Form for Individuals Who Purchased Coverage through the Health Insurance Marketplace Under the Affordable Care Act (ACA), most U.S. citizens and legal non-citizens will be required to report on their 2014 federal income tax return whether members of their household had qualifying health insurance coverage (called “minimum essential coverage”) for months in…

Read MoreFinal Rules on Health Insurance Marketplace Re-Enrollment

The Centers for Medicare & Medicaid Services (CMS) finalized a policy that provides current Health Insurance Marketplace consumers with a way to keep their current health plan. Generally, individuals enrolled in coverage through the Health Insurance Marketplace will be automatically enrolled unless they opt to enroll in a new plan. Accordin g to a CMS…

Read MoreEmployers: Three Health Care / ACA Compliance Q&A

Here are 3 great Q&A’s for ACA compliance We reimburse our management employees for their individual health insurance premiums via their paychecks. We add it on to their net payroll. Should we be taxing them on this amount or do we need to report it and they pay taxes on it when they file their personal…

Read MoreAffordable Care Act Questions? Open Enrollment 11-15-14

IRS Health Care Marketplace Subsidy Reconciliation The Affordable Care Act (ACA) … created health insurance subsidies in the form of premium tax credits and cost-sharing reductions to help eligible individuals and families purchase health insurance through the government-sponsored Health Insurance Marketplace (Marketplace). By reducing a taxpayer’s out-of-pocket premium costs, the subsidies are designed to make…

Read More