Affordable Care Act Questions? Open Enrollment 11-15-14

IRS Health Care Marketplace

IRS Health Care Marketplace

Subsidy Reconciliation

The Affordable Care Act (ACA) …

created health insurance subsidies in the form of premium tax credits and cost-sharing reductions to help eligible individuals and families purchase health insurance through the government-sponsored Health Insurance Marketplace (Marketplace). By reducing a taxpayer’s out-of-pocket premium costs, the subsidies are designed to make coverage through the Marketplace more affordable.

Subsidies became available beginning in 2014, at the same time the Marketplace became operational. The Marketplace’s open enrollment period for the 2014 plan year ended on March 31, 2014. The 2015 annual open enrollment period will begin on November 15, 2014.

If an enrollee is eligible for a premium tax credit, advance payments of the credit will be made directly to the insurance company on the family’s behalf. At the end of the year, the advance payments must be reconciled against the amount of the family’s actual premium tax credit, as calculated on the family’s federal income tax return.

On May 23, 2012, the Internal Revenue Service (IRS) published final regulations on the ACA’s health insurance subsidies. These regulations provide detailed rules for reconciling advance payments of the premium tax credit.

THE EXCHANGE HEALTH INSURANCE

THE EXCHANGE HEALTH INSURANCE

There are two federal health insurance subsidies available with respect to coverage purchased through the Marketplace: premium tax credits and cost-sharing reductions. Both of these subsidies vary in amount based on the taxpayer’s household income and reduce the out-of-pocket costs of health insurance for the insured.

• Premium tax credits are available for people with somewhat higher incomes (up to 400 percent of the Federal Poverty Level (FPL)), and they reduce out-of-pocket premium costs for the taxpayer.

• Reduced cost-sharing is available for people with lower incomes (up to 250 percent of the FPL). Through cost-sharing reductions, these individuals will be eligible to enroll in plans with higher actuarial values and have the plan, on average, pay a greater share of covered benefits. This means that coverage for these individuals will have lower out-of-pocket costs at the point of service (for example, lower deductibles and co-payments).

Subsidies are calculated on the taxpayer’s return using the taxpayer’s household income and family size for the taxable year. For purposes of determining eligibility for these subsidies, and the amount of any subsidy available, household income is determined using the taxpayer’s federal income tax return for that year. However, because these subsidies are provided when the individual purchases insurance, the Marketplace will generally be required to determine household income well before the individual files his or her tax return for that year.

To aid the Marketplace in making these determinations, the Marketplace uses an application for insurance that asks applicants to provide specific information about their current income. If the applicant’s current income is not steady or if it is expected to change, the applicant is asked to project his or her 2014 income. If the applicant provides no financial information, the Marketplace will rely on the individual’s federal income tax return from the previous year.

PREMIUM TAX CREDIT PAYMENTS

PREMIUM TAX CREDIT PAYMENTS

The premium tax credits are both refundable and advanceable. A refundable tax credit is one that is available to an individual even if he or she has no tax liability. An advanceable tax credit allows an individual to receive assistance at the time that he or she purchases insurance, rather than having to pay the premium out-of-pocket and wait to be reimbursed when filing his or her annual income tax return.

Advance payments of the premium tax credit will be made directly to the insurance company on the family’s behalf. At the end of the year, the advance payments are reconciled against the amount of the family’s actual premium tax credit, as calculated on the family’s federal income tax return. Any repayment due from the taxpayer is subject to a cap for taxpayers with incomes under 400 percent of the FPL.

RECONCILIATION OF HEALTH INSURANCE SUBSIDIES

At the end of each year, a taxpayer’s subsidy amount will be recalculated using the taxpayer’s household income as reported on his or her tax return, and any difference in the amounts must be reconciled.

If the taxpayer’s income has increased from the amount that he or she reported to the Marketplace, and as a result the taxpayer received a larger subsidy than he or she was entitled to, that individual may have to repay part of his or her subsidy. This could result in a smaller tax refund or a tax payment due for that individual. However, if, based on his or her household income, it is determined that a taxpayer is owed a greater premium tax credit than he or she received, the taxpayer will receive the excess as an income tax refund.

In addition to reconciling his or her own subsidy payments, a taxpayer must also reconcile all subsidies for coverage of any member of the taxpayer’s family. If subsidies are paid for coverage of an individual for whom no taxpayer claims a personal exemption deduction, the taxpayer who attested to the Marketplace that he or she intended to claim a personal exemption deduction for the individual (as part of the subsidy eligibility determination) must reconcile the subsidies.

Additional Income Tax Liability

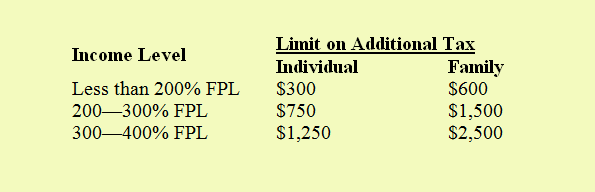

If it is determined that a taxpayer received a greater premium tax credit than he or she is owed, based on his or her household income, the taxpayer will be required to repay the excess as additional income tax liability. However, the ACA limits the amount of additional tax that may be imposed for taxpayers whose household income is less than 400 percent of the FPL. The limits are as follows:

For taxable years beginning in 2015, these limits may be adjusted to reflect changes in the consumer price index.

Taxpayers with household incomes at or above 400 percent of the FPL will be required to repay the entire amount of any subsidy overpayment.

Questions? Email me or give me a call – I’m happy to help!

Jim Brassard, ACA Certified Brassard Insurance jim@yoursecurity.com 215-345-1578