Here’s a true story about a woman who thought she was signing up for the ACA (“Obamacare”) insurance, but got scammed by a look-alike website. She Googled the Affordable Care Act and ended up on another website without her knowledge. The URLs are designed to confuse, and you need to look VERY carefully at the…

The IRS released the inflation adjustments for health savings accounts (HSAs) and their accompanying high deductible health plans (HDHPs) effective for calendar year 2019. Most limits increased from 2018 amounts. Annual Contribution Limitation For calendar year 2019, the limitation on deductions for an individual with self-only coverage under a high deductible health plan is $3,500. For calendar…

On October 6, 2017, the U.S. Departments of Health and Human Services, Labor, and the Treasury (the Departments) released final, interim regulations allowing non-governmental employers, institutions of higher education, and individuals with religious or moral objections to cease coverage for some, or all, contraceptive services. Background All non-grandfathered health plans must cover certain preventive items and services without cost-sharing, including contraceptive…

Many small closely held corporations and partnerships have a written agreement as to what must take place if: A shareholder or partner leaves the firm willingly Dies an untimely death Becomes disabled These are referred to as either “Buy Out Agreements or Corporate Stock Redemption Plans.” The problem with many of these agreements are most…

Brought to you by Kistler Tiffany Benefits Many employers offer high deductible health plans (HDHPs) to control premium costs and pair this coverage with health savings accounts (HSAs) to help employees with their health care expenses. An HSA is a tax-favored trust or account that can be contributed to by, or on behalf of, an…

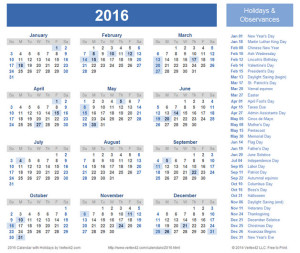

On May 4, 2015, the Internal Revenue Service (IRS) released Revenue Procedure 2015-30 to announce the inflation-adjusted limits for health savings accounts (HSAs) for calendar year 2016. The IRS announced the following limits for 2016: The maximum HSA contribution limit; The minimum deductible amount for high deductible health plans (HDHPs); and The…

New 1095-A Tax Form for Individuals Who Purchased Coverage through the Health Insurance Marketplace Under the Affordable Care Act (ACA), most U.S. citizens and legal non-citizens will be required to report on their 2014 federal income tax return whether members of their household had qualifying health insurance coverage (called “minimum essential coverage”) for months in…

The Centers for Medicare & Medicaid Services (CMS) finalized a policy that provides current Health Insurance Marketplace consumers with a way to keep their current health plan. Generally, individuals enrolled in coverage through the Health Insurance Marketplace will be automatically enrolled unless they opt to enroll in a new plan. Accordin g to a CMS…

Here are 3 great Q&A’s for ACA compliance We reimburse our management employees for their individual health insurance premiums via their paychecks. We add it on to their net payroll. Should we be taxing them on this amount or do we need to report it and they pay taxes on it when they file their personal…