Health Savings Account (HSA) Contribution Rules

Brought to you by Kistler Tiffany Benefits

Many employers offer high deductible health plans (HDHPs) to control premium costs and pair this coverage with health savings accounts (HSAs) to help employees with their health care expenses.

An HSA is a tax-favored trust or account that can be contributed to by, or on behalf of, an eligible individual for the purpose of paying qualified medical expenses. For example, individuals can use their HSAs to pay for expenses covered under their HDHPs until their deductibles have been met, or they can use their HSAs to pay for qualified medical expenses not covered by their HDHPs, such as dental or vision expenses.

HSAs provide a triple tax advantage—contributions, investment earnings and amounts distributed for qualified medical expenses are all exempt from federal income tax, Social Security/Medicare tax and most state income taxes. Due to an HSA’s potential tax savings, federal tax law includes strict rules for HSA contributions.

Who can contribute to an HSA?

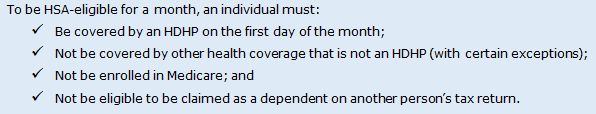

Only an eligible individual can establish an HSA and make HSA contributions (or have them made on his or her behalf). An individual’s eligibility for HSA contributions is generally determined monthly, as of the first day of the month.

HSA contributions can be made by the HSA accountholder or by any other person on his or her behalf, including an employer or family member. An individual who is no longer HSA-eligible may still contribute to his or her HSA (or have contributions made on his or her behalf) for the months of the year in which he or she was HSA-eligible.

How much can be contributed to an HSA each year?

For each month an individual is HSA-eligible, he or she may contribute one-twelfth of the applicable maximum contribution limit for the year. This limit is called the general monthly contribution rule. The applicable maximum contribution limit depends on whether the individual has self-only HDHP coverage or family HDHP coverage on the first day of the month.

- Self-only HDHP coverage is HDHP coverage for only one HSA–eligible individual.

- Family HDHP coverage is HDHP coverage for one HSA-eligible individual and at least one other individual (regardless of whether the other individual is HSA–eligible).

The maximum HSA contribution limits are subject to an annual adjustment for inflation. By June 1 of each calendar year, the Internal Revenue Service (IRS) publishes the cost-of-living adjustments that will become effective as of the next Jan. 1.

Except for rollover contributions, all HSA contributions made by or on behalf of an HSA–eligible individual are aggregated for purposes of applying the maximum contribution limit. However, HSA administrative fees or account maintenance fees paid by the HSA accountholder (or someone on his or her behalf) are not HSA contributions, and do not count toward the annual contribution limit. Also, all HSA contributions, except rollover contributions, must be made in cash. For example, HSA contributions cannot be made in stock or other property.

Except for rollover contributions, all HSA contributions made by or on behalf of an HSA–eligible individual are aggregated for purposes of applying the maximum contribution limit. However, HSA administrative fees or account maintenance fees paid by the HSA accountholder (or someone on his or her behalf) are not HSA contributions, and do not count toward the annual contribution limit. Also, all HSA contributions, except rollover contributions, must be made in cash. For example, HSA contributions cannot be made in stock or other property.

In addition, if an HSA accountholder has an Archer MSA, the maximum contribution limit for the HSA is reduced by any amounts contributed to the Archer MSA for the taxable year.

Keep in mind that there are some special contribution rules for individuals who are age 55 or older, mid-year HDHP enrollees and married spouses with family HDHP coverage. These rules, which are discussed below, may impact how much can be contributed to an individual’s HSA each year.

Who is eligible to make catch-up contributions?

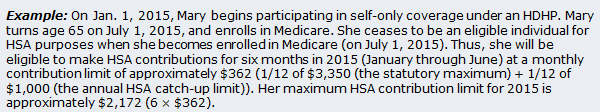

Individuals who are age 55 or older by the end of the tax year are permitted to make additional HSA contributions, called “catch-up contributions.” The maximum annual catch-up contribution is $1,000. Because the catch-up contribution limit is not adjusted for inflation, it remains the same year after year. As with the general HSA contribution limit, the catch-up contribution limit is determined on a monthly basis.

The HSA catch-up contribution limit is not reduced for the year in which the individual reaches age 55 if he or she reaches age 55 after Jan. 1. For example, an individual who is HSA-eligible for all of 2015 and who turns age 55 on Dec. 1, 2015, may make a full $1,000 catch-up contribution for 2015.

The HSA catch-up contribution limit is not reduced for the year in which the individual reaches age 55 if he or she reaches age 55 after Jan. 1. For example, an individual who is HSA-eligible for all of 2015 and who turns age 55 on Dec. 1, 2015, may make a full $1,000 catch-up contribution for 2015.

A married couple may make two HSA catch-up contributions, as long as both spouses are at least age 55. However, in order for a married couple to make two HSA catch-up contributions, a separate HSA must be established in the name of each spouse.

What is the full-contribution rule for mid-year enrollees?

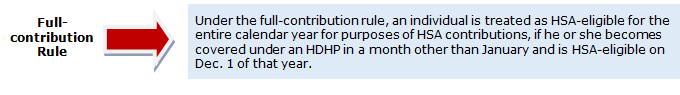

The full-contribution rule is an exception to the general rule that the maximum amount of HSA contributions for a year is determined monthly, based on the individual’s HSA eligibility for that month.

The eligible individual is treated as enrolled in the same HDHP coverage (that is, self-only or family coverage) as he or she has on the first day of the last month of the year. For example, if an individual first becomes HSA-eligible on Dec. 1, 2015, and has family HDHP coverage, he or she is treated as an eligible individual who had family HDHP coverage for all twelve months in 2015.

The eligible individual is treated as enrolled in the same HDHP coverage (that is, self-only or family coverage) as he or she has on the first day of the last month of the year. For example, if an individual first becomes HSA-eligible on Dec. 1, 2015, and has family HDHP coverage, he or she is treated as an eligible individual who had family HDHP coverage for all twelve months in 2015.

The full-contribution rule applies regardless of whether the individual was an eligible individual for the entire year, had HDHP coverage for the entire year, or had disqualifying non-HDHP coverage for part of the year. However, an individual who relies on this special rule must generally remain HSA-eligible during a 13-month testing period, with exceptions for death and disability.

The full-contribution rule applies to both the general monthly contribution limit and to the additional HSA catch-up contribution limit for eligible individuals who reach age 55 by the end of the year.

The full-contribution rule, however, does not change the requirement that expenses incurred before the date the HSA was established cannot be reimbursed by the HSA. An HSA is not established before the date that the HSA is actually established, even when individuals are treated as HSA–eligible for the entire year under the full-contribution rule.

How does the full-contribution rule work?

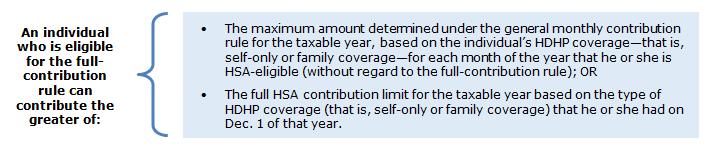

The full-contribution rule can increase, but not decrease, the amount that an individual would otherwise be eligible to contribute to his or her HSA under the general monthly contribution rule.

Thus, under the full-contribution rule, an individual who has self-only HDHP coverage for most of the taxable year, but who switches to family HDHP coverage late in the year and who still has family HDHP coverage on Dec. 1 of that year, will be able to contribute significantly more to his or her HSA for the year than if he or she had kept self-only HDHP coverage for all 12 months of the year.

Thus, under the full-contribution rule, an individual who has self-only HDHP coverage for most of the taxable year, but who switches to family HDHP coverage late in the year and who still has family HDHP coverage on Dec. 1 of that year, will be able to contribute significantly more to his or her HSA for the year than if he or she had kept self-only HDHP coverage for all 12 months of the year.

What is the testing period for the full-contribution rule?

What is the testing period for the full-contribution rule?

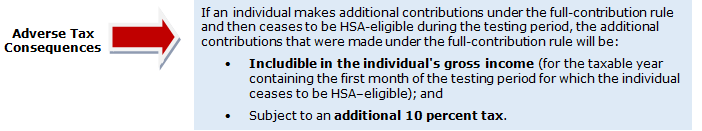

If an individual makes additional HSA contributions (or if contributions are made on his or her behalf) under the full-contribution rule, and the individual does not remain HSA-eligible during the 13-month testing period, he or she will experience adverse tax consequences.

These adverse tax consequences do not apply, however, if an individual loses his or her HSA eligibility during the testing period due to disability or death.

Also, to remain HSA-eligible during the testing period, an individual is not required to keep the same level of HDHP coverage during the testing period. Thus, if an HSA-eligible individual merely changes his or her HDHP coverage level (from self-only to family coverage, or vice versa) during the testing period, he or she will not suffer any adverse tax consequences.

The testing period begins on Dec. 1 of the year for which the HSA contributions were made, and it ends on Dec. 31 of the following year.

The amount that is included in the individual’s gross income is computed by subtracting the amount that could have been contributed under the general monthly contribution rule from the amount actually contributed under the full-contribution rule.

The amount that is included in the individual’s gross income is computed by subtracting the amount that could have been contributed under the general monthly contribution rule from the amount actually contributed under the full-contribution rule.

Earnings on the taxable amount are not included in gross income and are not subject to the 10 percent additional tax, as long as the earnings remain in the individual’s HSA or are used for qualified medical expenses.

The 10 percent additional tax for the failure to remain HSA-eligible during the testing period applies regardless of the individual’s age (that is, it applies even after the individual attains age 65).

The 10 percent additional tax for the failure to remain HSA-eligible during the testing period applies regardless of the individual’s age (that is, it applies even after the individual attains age 65).

This additional tax cannot be avoided by withdrawing the taxable amounts from the HSA. An amount included in an individual’s federal gross income because the individual failed to remain HSA-eligible during the testing period is not an “excess contribution.” Withdrawing the taxable amount (and not using the withdrawn amount for qualified medical expenses) will result in double taxation because the withdrawn amount will again be included in the individual’s gross income and (unless the individual has died, become disabled or attained age 65) will also be subject to the additional 20 percent tax on nonmedical distributions.

Are there any special contribution limits for spouses?

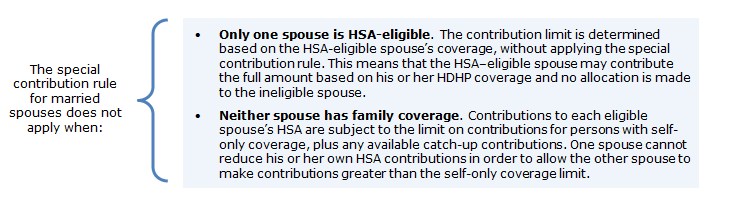

There is a special contribution rule for married individuals, which provides that if either spouse has family HDHP coverage, then both spouses are treated as having only that family coverage.

If both spouses are HSA-eligible, the HSA contribution limit calculated under this special contribution rule is a joint limit, which is divided equally between the spouses (unless they agree on a different division). This means that if both spouses are HSA-eligible and either has family HDHP coverage, the spouses’ combined contribution limit is the annual maximum limit for individuals with family HDHP coverage.

This special contribution rule applies even if one spouse has family HDHP coverage and the other has self-only HDHP coverage, or if each spouse has family HDHP coverage that does not cover the other spouse.

The special contribution rule for married spouses does not apply to catch-up contributions. Married couples who both are over age 55 may each make an additional catch-up contribution ($1,000) to their separate HSAs.

Spouses who are HSA-eligible may allocate the joint contribution limit in any way they want. They may divide the limit equally or allocate it between their HSAs in any proportion, including allocating it entirely to one spouse.

Spouses who are HSA-eligible may allocate the joint contribution limit in any way they want. They may divide the limit equally or allocate it between their HSAs in any proportion, including allocating it entirely to one spouse.

In addition, keep in mind that HSAs are individual trusts or accounts, which means that spouses cannot share a joint HSA. Also, if a spouse has non-HDHP coverage (such as a low-deductible health plan, general purpose FSA or HRA) that covers the other spouse, both spouses are ineligible for HSA contributions.

HSAs are commonly offered with HDHPs under an employer’s Section 125 plan (or a cafeteria plan). This allows employees to make their HSA and HDHP contributions as pre-tax salary reductions.if employees make pre-tax HSA contributions, can they change their elections during a plan year?

HSAs are commonly offered with HDHPs under an employer’s Section 125 plan (or a cafeteria plan). This allows employees to make their HSA and HDHP contributions as pre-tax salary reductions.if employees make pre-tax HSA contributions, can they change their elections during a plan year?

As a general rule, cafeteria plan elections are irrevocable for an entire plan year. This means that participants ordinarily cannot make changes to their cafeteria plan elections during a plan year. The IRS, however, allows a cafeteria plan to be designed to permit mid-year election changes in limited situations.

IRS Notice 2004-50 confirms that the irrevocable election rules do not apply to a cafeteria plan’s HSA benefit. An employee who elects to make HSA contributions under a cafeteria plan may start or stop the election or increase or decrease the election at any time during the plan year, as long as the change is effective prospectively. If an employer places additional restrictions on HSA contribution elections under its cafeteria plan, then the same restrictions must apply to all employees. Also, to be consistent with the HSA monthly eligibility rules, HSA election changes must be allowed at least monthly and upon loss of HSA eligibility.

What are the rules for employer HSA contributions?

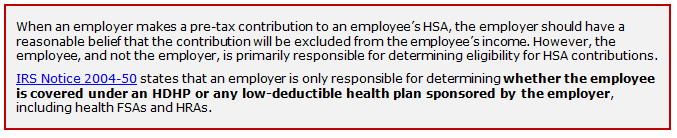

Employers may contribute to the HSAs of current or former employees. An individual’s HSA contribution limit is reduced by any employer contributions (including pre-tax salary deferrals under a cafeteria plan) made to his or her HSA (or Archer MSA).

In addition, if an employer makes HSA contributions outside of a cafeteria plan, the employer must make comparable contributions to the HSAs of all comparable participating employees. As a general rule, contributions are comparable if they are the same dollar amount or the same percentage of the HDHP deductible. If an employer fails to comply with the comparability requirement during a calendar year, it will be liable for an excise tax equal to 35 percent of the aggregate amount contributed by the employer to the HSAs of its employees during that calendar year.

In addition, if an employer makes HSA contributions outside of a cafeteria plan, the employer must make comparable contributions to the HSAs of all comparable participating employees. As a general rule, contributions are comparable if they are the same dollar amount or the same percentage of the HDHP deductible. If an employer fails to comply with the comparability requirement during a calendar year, it will be liable for an excise tax equal to 35 percent of the aggregate amount contributed by the employer to the HSAs of its employees during that calendar year.

The comparability rules do not apply to employer HSA contributions made through a cafeteria plan. Employer contributions to employees’ HSAs are made through the cafeteria plan when the cafeteria plan allows eligible participants to make pre-tax salary deferrals to fund their HSAs. When employer HSA contributions are made through a cafeteria plan, however, the employer’s contributions are subject to the nondiscrimination rules governing cafeteria plans.

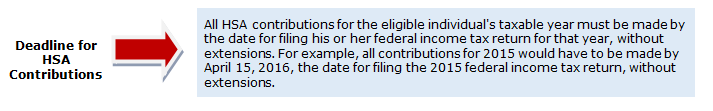

What is the deadline for making HSA contributions?

Although the dollar limit for HSA contributions is determined on a monthly basis, HSA contributions do not have to be made in equal amounts each month. An eligible individual can contribute in a lump sum or in any amounts or any frequency that he or she wants.

Are rollover contributions or transfers from other accounts allowed?

Are rollover contributions or transfers from other accounts allowed?

Rollovers from Other HSAs or Archer MSAs

HSAs may accept rollover contributions from another HSA or from an Archer MSA. These rollover contributions do not count toward the annual HSA contribution limit, and they are not required to be in cash. Also, an individual does not need to be HSA-eligible to make a rollover contribution from his or her existing HSA to a new HSA. To qualify as a rollover distribution, the amount must be distributed from the other HSA (or Archer MSA) to the HSA accountholder and then deposited into the individual’s HSA within 60 days of when the distribution was received.

This rollover exception only applies once every 12 months. In addition, HSA funds may be moved from one HSA trustee directly to another HSA trustee (called a trustee-to-trustee transfer). There is no limit on the number of trustee-to-trustee transfers allowed during a year.

Transfers from IRAs – Qualified HSA Funding Distributions

An HSA–eligible individual may irrevocably elect a direct trustee-to-trustee transfer of a qualified HSA funding distribution from his or her traditional IRA or Roth IRA into his or her HSA. Qualified funding distributions may not be made from ongoing SEP IRAs or SIMPLE IRAs.

Generally, only one qualified HSA funding distribution is allowed during the lifetime of an individual. Also, the distributions must be from an IRA to an HSA owned by the individual who owns the IRA, or, in the case of an inherited IRA, for whom the IRA is maintained. This means a qualified HSA funding distribution cannot be made to an HSA owned by any other person, including the individual’s spouse.

Qualified HSA funding distributions are counted as contributions when applying the annual HSA contribution limit for the taxable year in which they are contributed to the HSA.

In addition, the qualified HSA funding distribution rules require the individual to remain HSA–eligible during a testing period. The testing period begins with the month in which the qualified funding distribution is contributed to the HSA and ends on the last day of the twelfth month following that month. For example, if a qualified funding distribution is made on June 4, 2015, the testing period would begin in June 2015 and continue until June 30, 2016. If an individual loses his or her HSA eligibility at any time during the testing period, the amount of the qualified HSA funding distribution is included in the individual’s gross income, and the amount is subject to a 10 percent additional tax. These adverse tax consequences do not apply if an individual ceases to be HSA–eligible due to disability or death.

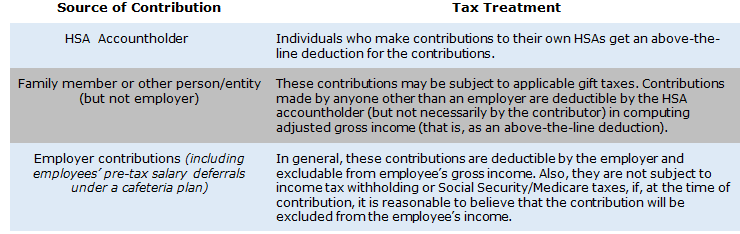

How are HSA contributions taxed?

All HSA contributions receive tax-favored treatment (unless they are excess contributions). The specific tax treatment, however, depends on who is making the contribution, as described in the table below.

HSA contributions that exceed an individual’s maximum contribution amount or that are made by or on behalf of an individual who is not HSA-eligible are considered “excess contributions.” Excess contributions are not deductible by the HSA owner. Also, employer HSA contributions are included in the gross income of the employee to the extent that they exceed the individual’s maximum contribution amount or are made on behalf of an employee who is not an eligible individual.

HSA contributions that exceed an individual’s maximum contribution amount or that are made by or on behalf of an individual who is not HSA-eligible are considered “excess contributions.” Excess contributions are not deductible by the HSA owner. Also, employer HSA contributions are included in the gross income of the employee to the extent that they exceed the individual’s maximum contribution amount or are made on behalf of an employee who is not an eligible individual.

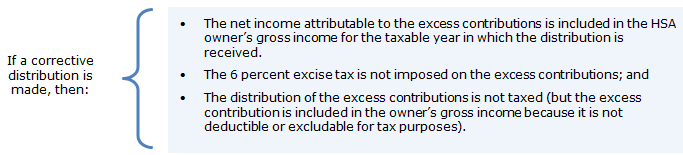

A 6 percent excise tax is imposed on the HSA owner for all excess contributions. The excise tax can be avoided if the excess contributions for a taxable year (and the net income attributable to those excess contributions) are distributed to the HSA owner by the deadline for filing the owner’s federal income tax return for the taxable year (that is, the following April 15).

The 6 percent excise tax is cumulative and will continue in future years if a corrective distribution is not made. For each year, the HSA owner must pay excise tax on the total of all excess contributions in the account. However, the amount on which the tax is assessed is reduced in certain circumstances. For example, if HSA contributions for any year are less than the maximum limit for that year, the amount subject to the excise tax is reduced (for that year and subsequent years) by the difference between the maximum limit for the year and the amount actually contributed.

The 6 percent excise tax is cumulative and will continue in future years if a corrective distribution is not made. For each year, the HSA owner must pay excise tax on the total of all excess contributions in the account. However, the amount on which the tax is assessed is reduced in certain circumstances. For example, if HSA contributions for any year are less than the maximum limit for that year, the amount subject to the excise tax is reduced (for that year and subsequent years) by the difference between the maximum limit for the year and the amount actually contributed.