Posts Tagged ‘HSA’

Health Savings Account (HSA) Contribution Rules

Brought to you by Kistler Tiffany Benefits Many employers offer high deductible health plans (HDHPs) to control premium costs and pair this coverage with health savings accounts (HSAs) to help employees with their health care expenses. An HSA is a tax-favored trust or account that can be contributed to by, or on behalf of, an…

Read MoreIRS Announces 2016 HSA Limits

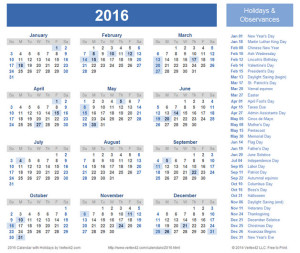

On May 4, 2015, the Internal Revenue Service (IRS) released Revenue Procedure 2015-30 to announce the inflation-adjusted limits for health savings accounts (HSAs) for calendar year 2016. The IRS announced the following limits for 2016: The maximum HSA contribution limit; The minimum deductible amount for high deductible health plans (HDHPs); and The…

Read More